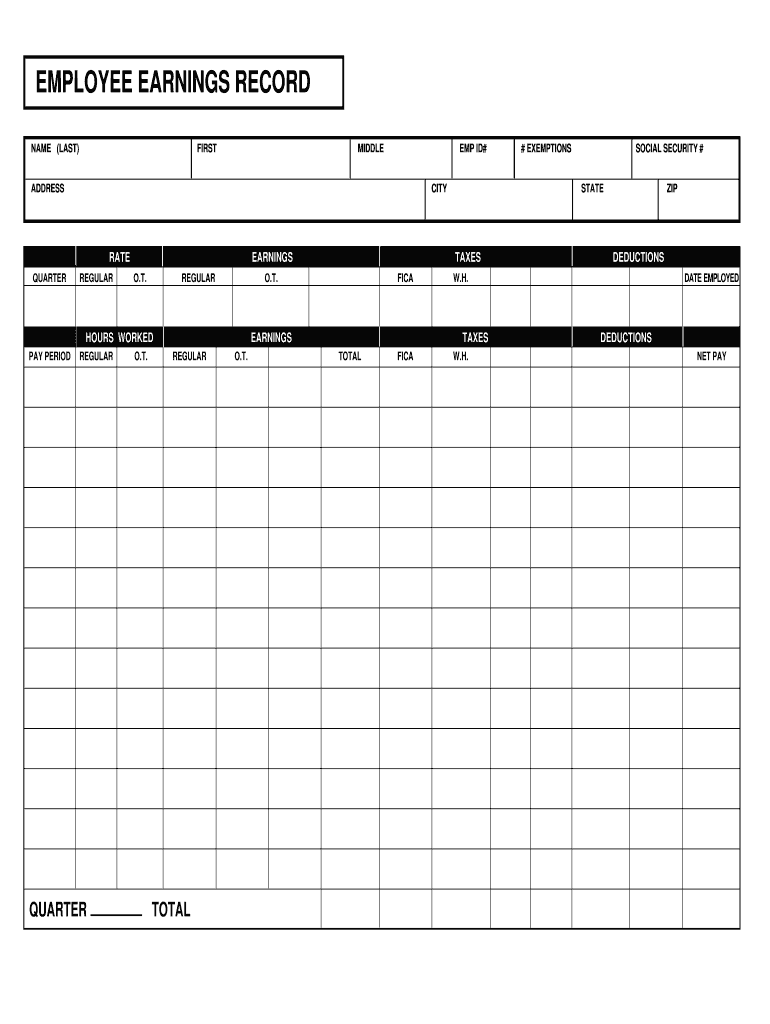

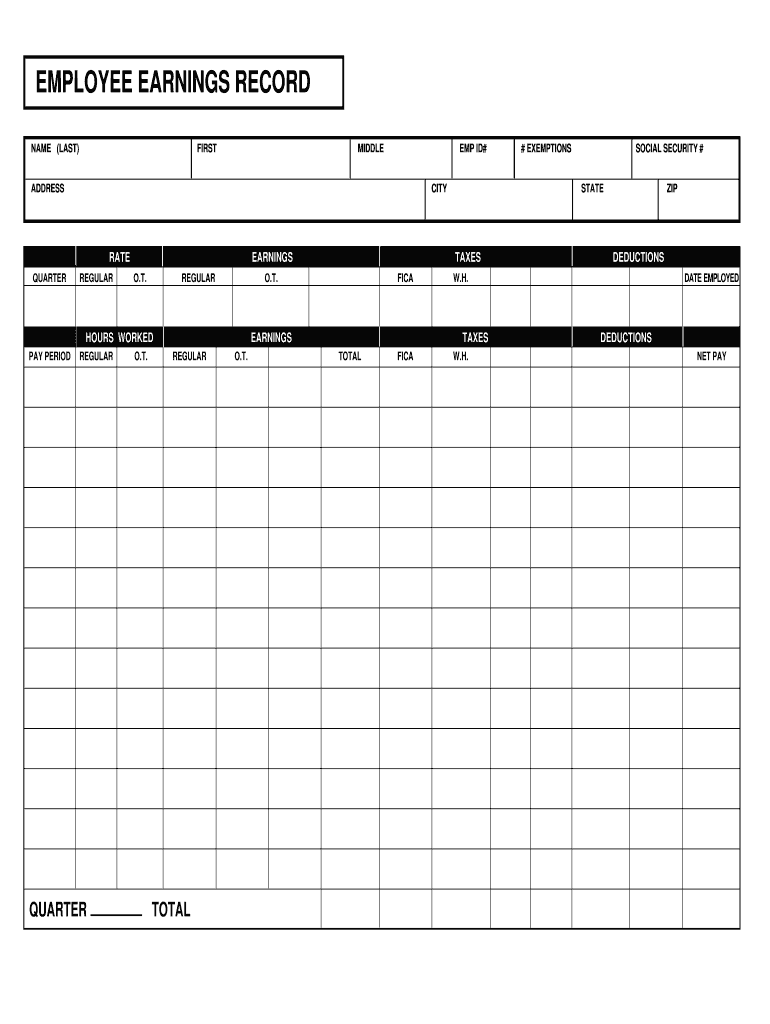

Employee Earnings Record free printable template

Show details

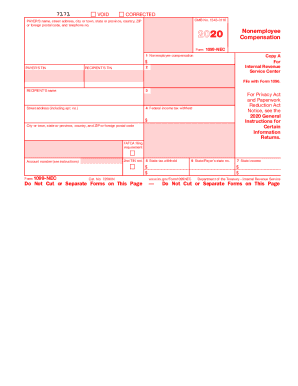

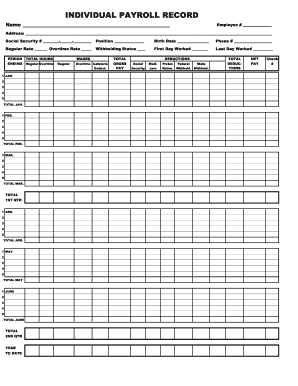

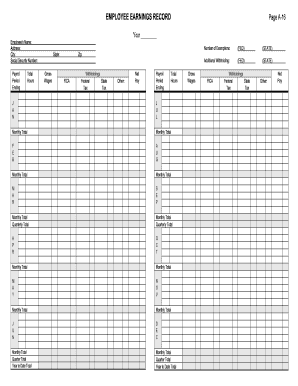

RATE REGULAR O.T. HOURS WORKED FIRST TOTAL EARNINGS EMPLOYEE EARNINGS RECORD NAME LAST ADDRESS QUARTER PAY PERIOD MIDDLE FICA CITY EMP ID TAXES W.H.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee earnings record form

Edit your employee earning record form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual earnings record form via URL. You can also download, print, or export forms to your preferred cloud storage service.

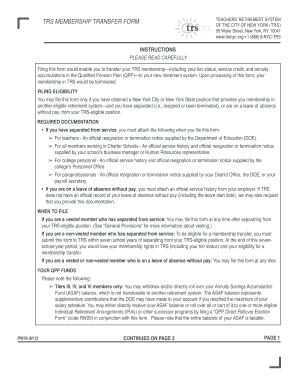

Editing employee earnings record pdf online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employees earning record form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to fill out employee 32 votes form

How to fill out Employee Earnings Record

01

Gather necessary information: Collect employee details including name, address, and Social Security number.

02

Record pay period: Clearly state the start and end dates for the pay period.

03

Enter gross earnings: Input total earnings before any deductions.

04

List deductions: Specify any deductions such as taxes, benefits, and retirement contributions.

05

Calculate net pay: Subtract total deductions from gross earnings to determine net pay.

06

Provide additional details: Include hours worked, overtime, and any bonuses if applicable.

07

Review for accuracy: Double-check all entries to ensure correctness before finalizing.

Who needs Employee Earnings Record?

01

Employers: To maintain accurate payroll records for their employees.

02

Payroll staff: For processing payroll and ensuring employee compensation is correct.

03

HR departments: To track employee earnings for benefit calculations and compliance.

04

Tax authorities: For reporting employee earnings and taxation purposes.

05

Employees: To keep a personal record of their earnings and deductions for financial tracking.

Fill

employees earnings record

: Try Risk Free

People Also Ask about employee's earnings record

What information is on an employee earnings record?

An employee's individual earnings record contains current data on that employee's earnings, deductions, and net pay for all pay periods, as well as cumulative earnings.

What is a detailed earnings report?

Certified/ on-Certified Detailed Earnings Information. Includes periods of employment or self-employment and the names and addresses of employers. OR. 2. Certified Yearly Totals of Earnings Includes total earnings for each year but does not include the names and addresses of employers.

What is employee earnings record?

Calculate net pay: The employee earnings record tells you each employee's net pay, which is the amount they'll take home in a given pay period after taxes. The employee earnings record shows how much is deducted from gross pay and for which taxes, so that employees always know how their take-home pay is determined.

Which items are included in the employees earnings records?

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

What is the difference between an employee earnings record and a payroll register?

The payroll register shows gross earnings, deductions, net pay, and taxable earnings for a payroll period. The employee earnings record shows the gross earnings, deductions, and net pay for an employee for an entire calendar year.

What is included in the employee earnings record?

An employee's individual earnings record contains current data on that employee's earnings, deductions, and net pay for all pay periods, as well as cumulative earnings.

What information is on an earning record?

Earnings record is part of a person's social security statement which details the person's earnings over their lifetime. The earnings record is used to determine a person's eligibility for and amount of disability, retirement, and other benefits.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee earnings records online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your employee earnings record template to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in employee earning record form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing employee earning records and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit employee earnings record example on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing employee earnings record form.

What is Employee Earnings Record?

An Employee Earnings Record is a document that provides a detailed summary of an employee's earnings, deductions, and taxes withheld over a specific period, often used for payroll and tax reporting purposes.

Who is required to file Employee Earnings Record?

Employers are required to file Employee Earnings Records for all employees to accurately report their earnings, withholdings, and contributions for tax and social security purposes.

How to fill out Employee Earnings Record?

To fill out an Employee Earnings Record, include the employee's name, Social Security number, pay period dates, gross earnings, itemized deductions, taxable wages, and the amounts withheld for federal, state, and local taxes.

What is the purpose of Employee Earnings Record?

The purpose of the Employee Earnings Record is to maintain accurate records of an employee's earnings and withholdings, ensuring that both the employer and employee comply with tax regulations and can verify income for purposes like loans or benefits.

What information must be reported on Employee Earnings Record?

The information that must be reported on an Employee Earnings Record includes the employee's full name, Social Security number, gross wages, deductions, net pay, and taxes withheld for the relevant period.

Fill out your Employee Earnings Record online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Earnings Record Printable is not the form you're looking for?Search for another form here.

Keywords relevant to what is the difference between 4

Related to employees earning record form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.